Tesla China Crisis: Overworked Staff, Fierce Competition, and Fading Glory

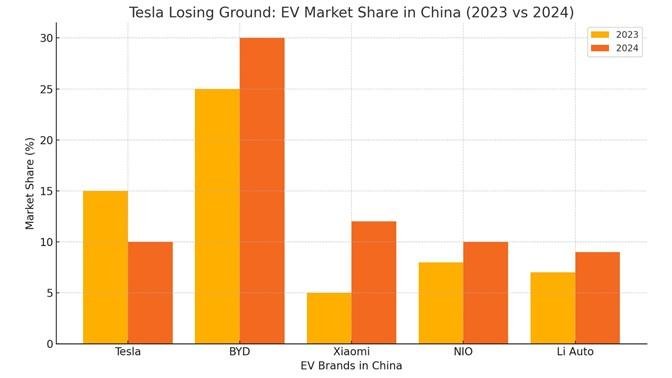

Tesla’s stronghold in China—once a key driver of its global success—is quickly unraveling. Once celebrated as a premium electric vehicle (EV) brand, Tesla is now being squeezed from all sides in the world’s largest EV market. The company is not only facing cutthroat competition from rising Chinese automakers like BYD, Xiaomi, NIO, and Li Auto but also dealing with internal challenges that are taking a toll on its workforce. So, what’s going wrong for Tesla in China?

Between 2020 and 2023, China was a major part of Tesla’s growth story. With strong sales of the Model 3 and Model Y, the American automaker thrived in a market that was eager for sleek, tech-forward EVs.

But the game has changed. Chinese automakers have raised the bar. Brands like Xiaomi, known for consumer electronics, are now making waves with their own electric cars. The Xiaomi SU7 has already overtaken Tesla’s Model 3 in popularity, and Xiaomi is now working on a Model Y competitor.

Meanwhile, Tesla has tried to counter with updates to its Model Y and attractive 0% financing offers—but the numbers suggest it’s not working.

Sales Targets Push Workers to the Brink

With competition ramping up, Tesla is putting immense pressure on its sales teams in China. A recent report by Jiemian News, which includes firsthand accounts from current and former Tesla employees, paints a grim picture: Tesla sales staff are working 13 hours a day, seven days a week.

That’s right—no weekends, no breaks, just relentless pressure to sell more cars in a tougher market. Salespeople in cities like Beijing are being asked to sell one car per day—roughly 30 per month. But many report that they’re lucky to sell 3 to 4 vehicles a week. To even get close to their targets, they’re required to:

- Create 10 new customer profiles daily

- Send out 3 online test drive invitations

- Complete 4 test drives—every single day

That kind of grind, with minimal pay, is leading to skyrocketing turnover. At one store in Beijing, the entire sales team turned over in just six weeks. A salesperson put it bluntly: “The days when customers came to us and placed orders without any effort are gone forever.”

Part of Tesla’s early success in China came from its perception as a luxury, innovative brand. But with so many new EVs on the market—many of them tech-rich, stylish, and cheaper—Tesla’s allure is fading.

The company primarily sells lower-cost, rear-wheel-drive (RWD) Model 3 and Model Y units in China, both of which have thin profit margins. Add to that the 0% financing deals Tesla uses to stay competitive, and it becomes clear that the company is struggling to make money in China. In other words, Tesla is working harder and earning less.

Unlike in North America and Europe, where Elon Musk’s political antics have affected Tesla’s brand, Chinese consumers historically weren’t influenced by his image. But that might be changing—and fast.

With U.S.-China trade tensions escalating—especially under the influence of Donald Trump’s trade war policies—Chinese buyers are starting to shy away from American brands altogether. Even if Tesla isn’t directly tied to the U.S. government, its American identity makes it a target in a politically sensitive environment. This geopolitical pressure is likely to accelerate Tesla’s decline in China.

What Tesla Needs to Fix

If Tesla hopes to reclaim even a portion of its dominance in China, several things need to happen:

- Revamp the product lineup: Competing against brands like BYD and Xiaomi requires more than minor updates. Tesla needs fresh, innovative vehicles tailored for the Chinese consumer—at competitive prices.

- Rethink labor practices: Burning out your frontline staff is not a long-term strategy. Tesla must improve work-life balance and pay if it hopes to retain talent in its sales force.

- Build a better local brand: While Tesla still benefits from name recognition, its image in China is slipping. The company needs to invest in localized marketing and community trust to stay relevant.

- Prepare for political headwinds: Trade relations are out of Tesla’s control, but the company must factor this into its strategy. Diversifying production or forming local partnerships might offer a buffer.

Tesla’s current reality in China is a far cry from its once-glorious rise. It’s being outpaced by local competitors, undermined by political tensions, and bogged down by internal pressure on employees. The challenges are real—and growing.

Whether Tesla can regain its footing in China depends on bold action, smarter strategy, and a willingness to adapt. As the EV race heats up, one thing is certain: Tesla can’t afford to keep playing the same game and expect a different outcome.

PEOPLE WHO READ THIS, ALSO READ