Ford’s future in Germany is looking increasingly uncertain, following a major announcement that sent shockwaves through the workforce and trade unions. On November 20, 2023, Ford revealed plans to cut 4,000 jobs across Europe by 2027, with the majority of those cuts—approximately 2,900 positions—happening in Germany. This downsizing is part of Ford’s strategy to address “significant losses” in recent years, but it also highlights larger challenges the company is facing as the global automotive market shifts, especially with the rise of electric vehicles (EVs).

Ford’s German Workforce: A Bleak Outlook

Ford’s job cuts have sparked a wave of backlash in Germany, with strong reactions from both the public and political figures. Jochen Ott, leader of the SPD parliamentary group in North Rhine-Westphalia, criticized the decision, claiming it broke a prior agreement from February 2023. Ott expressed that the timing and lack of transparency surrounding the announcement were “a blatant breach of trust.”

Germany’s largest trade union, IG Metall, has also weighed in, warning that these cuts pose a serious threat to the future of Ford’s operations in the country. Ford’s Cologne plant, where the company builds the electric Explorer and Capri models, remains one of its largest in Germany. However, with the job cuts, the company is set to reduce its workforce in Cologne by 25% over the next four years. This marks a sharp contrast to Ford’s workforce size from just a decade ago, as the company is now planning to halve its German workforce by 2027.

The Challenge of EV Demand and Competition

Ford’s struggles in Europe are largely attributed to slow demand for its electric vehicles. Although the company launched two electric models, the Explorer and Capri EVs, at its Cologne plant, a lack of sufficient consumer interest is forcing Ford to scale back production. This is not just a problem for Ford—it’s a symptom of a broader challenge facing legacy automakers as they try to compete with a growing influx of electric vehicles from new competitors.

One major source of this competition comes from Chinese automakers like BYD, NIO, and MG. These companies are rapidly expanding into the European market, offering low-cost EVs that are appealing to consumers. Chinese EVs are gaining traction in Europe, as they are able to provide advanced technology at more competitive prices, which puts pressure on established brands like Ford, VW, and Toyota.

Ford vs. The Rise of Chinese EVs

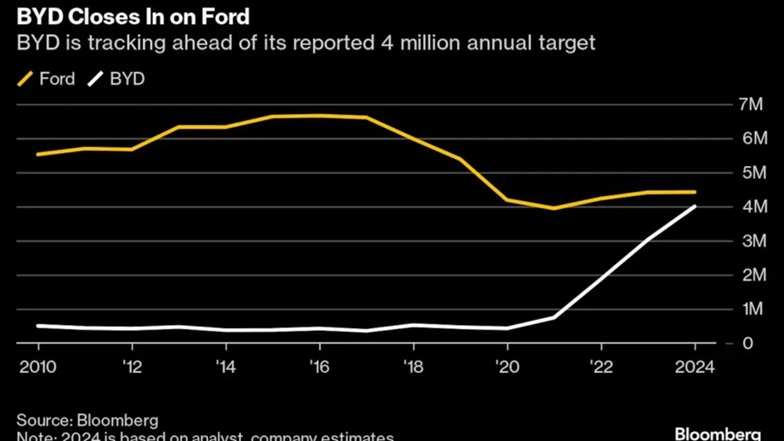

The threat posed by Chinese automakers is becoming more apparent by the day. For example, BYD has recently surpassed Nissan and Honda in global car deliveries. The company is quickly closing in on Ford, and it might not be long before BYD becomes a more significant player in the global market than the American automaker. CEO Jim Farley has acknowledged the challenge, stating that Ford, which struggled to compete with Japanese and South Korean automakers in the past, now faces a new battle with China’s emerging car giants.

To respond, Ford is adjusting its strategy. The company plans to focus on smaller, more affordable electric vehicles, using a new low-cost platform. While this shift could help the company become more competitive in the EV space, it’s a move that won’t bear fruit until 2027, with the launch of a midsize electric truck. Unfortunately, by then, the market could be completely different, with competition from established players and newer entrants already well underway.

What’s Next for Ford in Europe?

The road ahead for Ford in Germany—and in Europe as a whole—looks challenging. With new job cuts on the horizon, many are questioning whether Ford can remain a key player in the European market. The company is betting on its new line of smaller, more affordable EVs, but the competition is fierce, and the timeline for these new models might be too late to make a significant impact.

As for the employees facing job losses, it’s a difficult period. Ford’s decision to cut thousands of jobs in Germany, combined with the pressure of the growing electric vehicle market, presents a tough future for both the automaker and its workers. The road to recovery will depend on Ford’s ability to adapt to the rapid changes in the automotive industry, particularly the shift towards EVs. But with new, aggressive competitors entering the market, Ford’s path forward is uncertain.

Ford’s Challenges in Germany and Beyond

| Challenge | Impact | Ford’s Response |

|---|---|---|

| Job Cuts in Germany | 2,900 job cuts in Cologne by 2027 | Downsizing to cut costs amid financial losses |

| Slow EV Demand | Underwhelming sales of the electric Explorer and Capri | Focus on smaller, more affordable EVs starting in 2027 |

| Rising Competition from China | Chinese EV brands like BYD gaining ground in Europe | Shifting to low-cost EV platform for future models |

| Economic Struggles | Significant losses in recent years | Reducing workforce and adjusting production strategies |

The future of Ford in Germany is uncertain, and its ability to adjust to the changing automotive landscape will determine whether it can thrive or continue to struggle in the face of rising competition and shifting market demands. Only time will tell if the American automaker can regain its footing in Europe.

PEOPLE WHO READ THIS, ALSO READ