Tesla is at a major crossroads—and the entire auto industry is watching closely. Once the undisputed leader of the electric vehicle (EV) revolution, Tesla is now grappling with falling sales, investor doubts, political drama, and increasing competition. With its latest earnings call looming, the pressure is on like never before.

So, what exactly is going on with Tesla? Why are analysts so concerned? And most importantly, can the company bounce back?

Sales Are Dropping

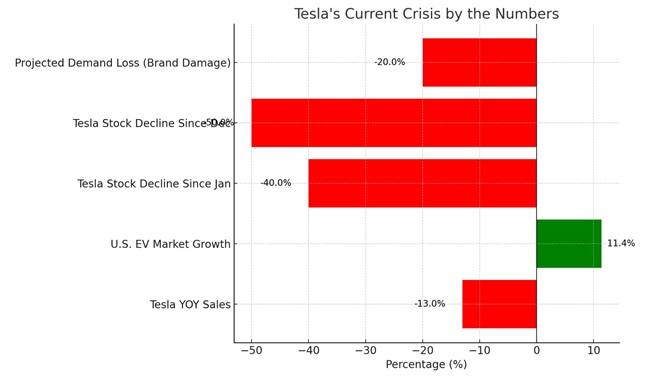

For the first time in years, Tesla is reporting a drop in global vehicle deliveries. That’s a big deal—especially since the EV market overall is still growing. In the U.S. alone, EV sales rose 11.4% recently, but Tesla’s deliveries fell by 13% year-over-year.

In short, while more people are buying EVs, fewer of them are choosing Teslas.

That’s not the kind of headline investors like to see. Tesla’s stock has already fallen more than 40% since the start of 2025—and the selloff is continuing ahead of the company’s earnings report.

Deep Discounts Hint at Trouble

To keep cars moving off lots, Tesla has been offering steep discounts and 0% APR financing deals. From Cybertruck price cuts to subsidized leases on the Model Y, the company is clearly trying to boost demand with incentives.

But this approach comes at a cost: shrinking profit margins. Barclays and Wells Fargo have both warned that Tesla’s profits could take a serious hit. Wells Fargo even highlighted weak demand in key markets like the U.S. and China—two of Tesla’s most important regions.

Analysts Are Losing Confidence

Several financial institutions have lowered their expectations for Tesla. Here’s what some of them are saying:

- Deutsche Bank slashed its delivery forecast and lowered Tesla’s stock price target.

- JPMorgan issued one of the most alarming warnings, calling out “unprecedented brand damage” due to CEO Elon Musk’s controversial behavior.

- JPMorgan’s new price target? Just $120 per share, the lowest of any major firm.

Even long-time Tesla supporters are concerned. The big question isn’t just about sales—it’s about the brand itself.

Tech Promises vs. Reality

Tesla once claimed that every car it sold came equipped for Full Self-Driving (FSD). But recently, the company admitted that many older models will need hardware upgrades.

That’s raising more questions:

- What’s the timeline for affordable new models?

- Is the robotaxi dream still alive?

- Can Tesla upgrade existing vehicles without frustrating customers?

Investors want real answers during this earnings call.

“Code Red”: Where’s Elon Musk?

Another major issue? Elon Musk seems distracted.

While Tesla struggles, Musk has been spending more time in political circles than running the company. He’s taken on a government advisory role (humorously nicknamed “DOGE”) and has been very vocal in U.S. politics.

Wall Street is not impressed. Dan Ives, a well-known analyst at Wedbush Securities, called the situation a “code red” moment. In his words:

“Musk needs to leave the government, take a major step back from DOGE, and get back to being CEO of Tesla full-time.”

Ives believes Tesla is losing up to 20% of future demand just because of Musk’s political image. Many consumers now associate Tesla with controversial politics—turning them toward other EV brands.

There’s no denying it: Tesla’s image isn’t what it used to be. The company, once a symbol of innovation and clean energy, is now facing public protests and political backlash. In the U.S., Europe, and even China, some buyers are actively avoiding Tesla due to its association with Musk’s politics.

And the numbers show it. Since mid-December, Tesla’s stock has fallen over 50%. That’s not just a dip—it’s a nosedive. Musk’s government role is set to expire by the end of May, which could bring him back to Tesla full-time. But it’s unclear whether his focus will truly return.

Analyst Dan Ives summed it up best: “If Musk leaves politics, Tesla can bounce back. But if he stays, brand damage will grow.” This moment feels like a fork in the road. Will Tesla refocus and reclaim its place as EV leader? Or will it fall further behind as competition tightens?

🇩🇪 Meanwhile, Volkswagen Plans Its Move

While Tesla wrestles with internal struggles, Volkswagen is playing the long game. With the Trump administration hinting at new auto tariffs, VW is negotiating to avoid steep import taxes. One proposed solution? Building Audis in the U.S.

Currently, most Audis sold in America are imported. But that may soon change. VW CEO Oliver Blume said that the brand is in “constructive discussions” with U.S. officials to move some production stateside. That’s a smart play. Building cars in the U.S. could help Volkswagen avoid tariffs and appeal to American buyers.

Volkswagen already builds the Atlas and ID.4 in Tennessee and has other models made in Mexico. Shifting Audi production to the U.S. would be a big step—but one that could pay off if tariffs go through.

Here’s the real kicker: Tesla’s competition has never been stronger. Nearly every major automaker—from Ford to Hyundai to BMW—is rolling out new EVs. Many offer lower prices, better incentives, or fresher tech. Tesla’s once-dominant market share is now slipping worldwide. In simple terms: people are buying EVs—they’re just not buying Teslas.

So here’s the million-dollar question: What would it take for you to buy a Tesla today?

Would it be:

- A cheaper model?

- Less political drama?

- Better customer support or faster updates?

Tesla needs to win back both buyers and investors. That means more than just flashy features or price cuts—it means rebuilding trust.

Today’s earnings call could be one of the most important in Tesla’s history. With falling sales, intense scrutiny, and leadership questions hanging in the air, the world is waiting to see if Tesla can steady the ship—or if more turbulence lies ahead. One thing is clear: this isn’t just business as usual. It’s a “code red” moment.

PEOPLE WHO READ THIS, ALSO READ