The 2024 Global EV Industry ( electric vehicle (EV)) sector is facing turbulent times, with different automakers navigating various challenges. As the industry inches closer to an all-electric future, manufacturers from across the globe are reassessing their strategies to stay competitive in a rapidly changing market.

Key Points to Watch:

- Toyota’s EV Strategy Shift: Toyota, historically skeptical about fully electric cars, is slowing down its EV production targets for 2026.

- German Automakers in Crisis: Volkswagen and other German giants are struggling to keep up with China’s aggressive push into the EV market.

- South Korea’s Battery Safety Measures: In response to recent EV fires, South Korea is mandating battery transparency, aiming to ensure consumer trust in EV technology.

EV Industry Challenges by Region

| Country | Major Challenges | Key Actions |

|---|---|---|

| Japan (Toyota) | EV market slowdown, hybrid success | Government providing $2.4 billion in EV subsidies for battery production |

| Germany (VW) | Declining sales in China and Europe, high costs | VW facing potential factory closures and emergency cost-cutting measures |

| South Korea | Battery fires, safety concerns | Mandating full transparency on battery suppliers and manufacturing standards |

Toyota’s 2026 EV Plans: A Slow Shift

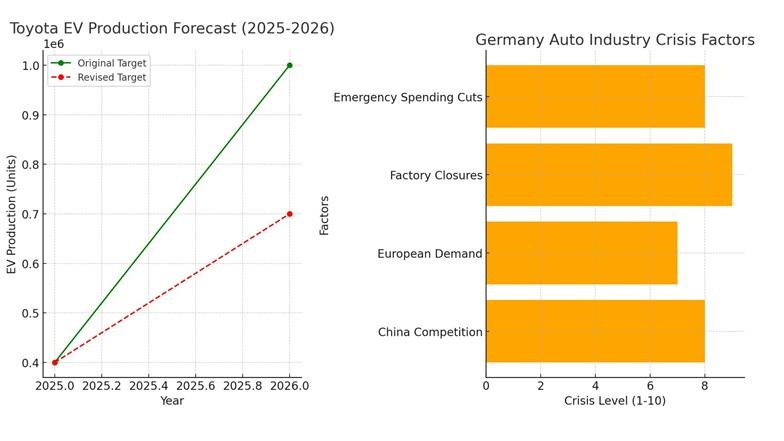

Toyota has recently revised its 2026 global EV production forecast by 30%, reducing the expected output to 1 million cars. While hybrid vehicles continue to perform well globally, fully electric cars are proving to be a long-term rather than immediate goal for the company. In 2025, Toyota plans to produce 400,000 EVs, with a more aggressive push expected the following year.

To counter China’s dominance in the battery market, the Japanese government has stepped in, offering billions in subsidies to strengthen the country’s battery supply chain and support Toyota’s EV ambitions.

German Auto Industry Struggles

Germany’s auto sector, particularly Volkswagen, is facing unprecedented difficulties. The company, once a leader in the transition to electric vehicles, is now reckoning with factory closures and emergency cost cuts. One key issue is the rapid growth of Chinese automakers, who are producing more affordable and better-performing EVs, eating into VW’s market share.

Despite this, some analysts believe that hybrid vehicles may remain a critical part of the industry’s future. This could offer a glimmer of hope for VW, even though its hybrid offerings remain limited in key markets like the U.S.

Here are three graphs based on the provided content:

- Toyota EV Production Forecast (2025-2026): This graph shows the difference between Toyota’s original and revised electric vehicle production targets, reflecting their shift in plans.

- Germany Auto Industry Crisis Factors: This bar chart highlights the key challenges facing Germany’s auto industry, including competition from China and economic pressures.

- South Korea Battery Safety Measures: This chart illustrates the progress of South Korea’s safety measures in battery transparency, certification, and mandatory inspections.

These visualizations help simplify the complex industry shifts mentioned in the blog.

South Korea: Focus on Battery Safety

Amid a spate of EV fires, South Korea is addressing battery safety concerns head-on. The government has introduced mandatory battery transparency for electric car makers, requiring them to disclose their battery suppliers and production methods. This move is designed to restore consumer confidence, particularly in high-density urban areas where EVs are becoming more common.

Additional measures include expanding the range of mandatory battery inspections and fast-tracking the implementation of a battery certification system to ensure the highest safety standards.

Navigating the EV Chaos

The global EV industry is at a pivotal moment, with different regions facing unique challenges. Toyota’s recalibrated approach, Germany’s market crisis, and South Korea’s safety-first policies highlight the complexity of the transition to electric mobility. As the industry evolves, success will depend on navigating these hurdles while balancing cost, consumer demand, and technology.

The next few years will reveal which automakers can survive the storm and emerge stronger in the race to an all-electric future.

PEOPLE WHO READ THIS, ALSO READ