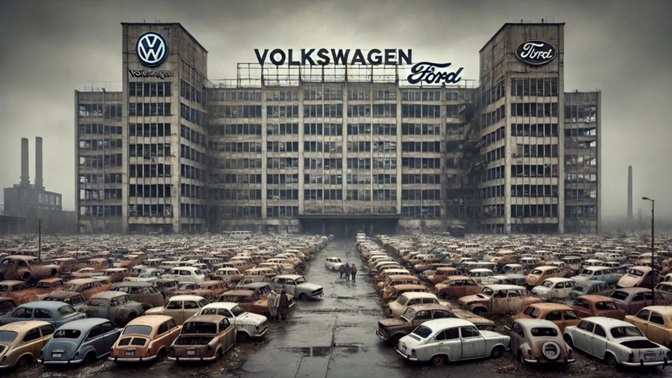

The German automotive industry, once a powerhouse of innovation and profitability, now faces an existential Automotive Crisis. Icons like BMW, Audi, and Volkswagen (VW) are grappling with plummeting profits, stiff competition from Chinese automakers, and the rocky transition to electric vehicles (EVs). The stakes are high, as these companies’ survival could shape the future of not just the automotive world but also Europe’s economic stability.

The Numbers Speak Volumes

The extent of the crisis is evident in recent financial results:

- BMW’s profits plummeted by 84% in Q3 2024, dropping from nearly €3 billion to just €476 million.

- Audi reported an even steeper decline, with a 91% reduction in profits.

- Volkswagen, facing similar struggles, is preparing to cut over €10 billion in costs while bracing for potential strikes.

These stark figures highlight the immense challenges these automotive giants are facing, challenges that stem from both internal missteps and external pressures.

China: From Golden Opportunity to Nightmare

China, once the largest growth market for German automakers, has now become their greatest challenge. With the rise of domestic automakers like BYD, Geely, NIO, and XPeng, German brands are losing ground at an alarming rate.

The issue isn’t just about market share but also technology and pricing. Chinese EVs are not only affordable but also cutting-edge, leaving legacy European manufacturers scrambling to compete. Audi has taken a bold step by partnering with SAIC, a state-backed Chinese firm, to launch a new EV brand tailored for China. However, even this drastic move underscores the desperate measures German automakers are taking to stay relevant.

The Electric Transition: A Tough Road Ahead

The shift to EVs has exposed structural weaknesses in the German auto industry:

- Audi’s Delays: The Q6 e-tron launch is two years behind schedule, signaling struggles with software and production.

- BMW’s EV Sales: While BMW saw a 10% rise in EV sales in Europe and the U.S., it failed to compensate for losses in China.

- Volkswagen’s Software Woes: VW’s software subsidiary, Cariad, has faced delays and mounting debt, hindering the launch of new EV models.

This inability to adapt swiftly to electrification is eroding profits and market share. While Tesla, the EV market leader, continues to thrive with innovations and agile product updates, German manufacturers are bogged down by legacy systems and inefficiencies.

The Cost of Crisis: Jobs and Strikes

The financial turmoil has also translated into labor challenges:

- Audi may eliminate up to 2,000 jobs from its development department.

- VW is considering cutting salaries by 10% and freezing wage increases until 2026, in addition to potentially closing factories in Emden and Zwickau.

- IG Metall, Germany’s powerful labor union, is warning of strikes in December 2024, adding another layer of uncertainty for automakers.

These workforce reductions and potential strikes could destabilize the already fragile situation further, affecting production, morale, and long-term growth prospects.

Challenges Beyond the Automotive Sector

The broader geopolitical and economic environment compounds the automotive industry’s troubles:

- Rising Energy Costs: The war in Ukraine and the loss of cheap Russian gas have significantly increased operational costs in Germany.

- Geopolitical Tensions: Proposed U.S. tariffs on European cars under the Trump administration threaten BMW and VW’s profitability in a key market.

These external pressures exacerbate the internal inefficiencies of German automakers, creating a perfect storm of challenges.

Reinvent or Perish: A Path Forward

For BMW, Audi, and Volkswagen, the path to survival hinges on bold innovation and strategic pivots:

- Competitive Pricing: The strategy of selling fewer cars at higher prices has backfired, allowing Chinese automakers to dominate the affordable EV market. German brands must introduce budget-friendly models without compromising quality.

- Massive Software Investments: Software capabilities are now as crucial as horsepower. Automakers must catch up in areas like autonomous driving, infotainment systems, and connectivity to stay competitive.

- Innovative Designs: German cars need to embrace modern design principles and user-friendly features like fast charging, wireless connectivity, and smart interiors. Basic updates like improved charging systems, bidirectional power transfer, and seamless door automation are now industry standards.

- Diversification: Over-reliance on premium segments in the U.S. and China is risky. German automakers must explore diverse markets and product categories to reduce geopolitical vulnerabilities.

- Faster EV Adoption: Streamlining production processes and cutting through bureaucratic delays will allow German automakers to bring EVs to market faster, competing more effectively with agile rivals.

German Automakers vs. Chinese Rivals

| Aspect | German Automakers | Chinese Automakers |

|---|---|---|

| Pricing | Premium pricing, limited affordability | Competitive pricing across all segments |

| Technology | Lagging in software and connectivity | Advanced, user-friendly technology |

| Market Adaptability | Slow to innovate, delays in EV launches | Rapid innovation, agile product development |

| Production Costs | Higher due to energy prices and legacy systems | Lower costs with streamlined processes |

| Global Reach | Strong in Europe and U.S., declining in China | Expanding aggressively worldwide |

The Social and Economic Ripple Effects

The decline of Germany’s automotive giants could have far-reaching consequences:

- Economic Impact: The auto industry is a cornerstone of Germany’s economy. Its downfall would affect supply chains, employment, and GDP.

- Technological Leadership: Germany risks losing its edge as a global leader in engineering and innovation.

- European Unity: Struggles in Germany could destabilize the broader EU economy, creating ripple effects across member states.

The Verdict: Time is Running Out

The German automotive industry is at a crossroads. BMW, Audi, and Volkswagen must act swiftly and decisively to overcome this unprecedented crisis. The next few months will test their ability to adapt to new market realities, including fierce competition from China, a challenging EV transition, and geopolitical headwinds.

Failing to evolve could spell the end of Germany’s automotive empire, leaving a void in a sector that has long defined the country’s industrial identity. For now, it’s a race against time—and the stakes couldn’t be higher.

By focusing on innovation, accessibility, and agility, these iconic brands can still steer away from the brink of collapse. Whether they succeed will determine not just their future but also the trajectory of the global auto industry.

PEOPLE WHO READ THIS, ALSO READ