Electric vehicle (EV) sales in the U.S. are off to a strong start in 2025—but the road ahead could be bumpy. While Tesla, the long-time EV leader, is starting to lose steam, other automakers like General Motors, BMW, Ford, and Hyundai are stepping up and gaining momentum. Here’s what’s happening in the EV world, what it means for drivers, and what could derail the industry’s progress.

EV Sales Are Up

According to data from Cox Automotive, U.S. electric vehicle sales rose 11.4% in the first quarter of 2025 compared to the same period last year. Nearly 300,000 electric cars found new homes between January and March, showing that demand is still on the rise—even if the pace has slowed slightly from previous years.

Last year, Americans purchased a record-breaking 1.3 million EVs. That momentum has mostly continued, although it’s clear that the industry is transitioning from selling to early adopters to convincing more mainstream consumers to make the switch.

📉 Tesla Stumbles as the Market Shifts

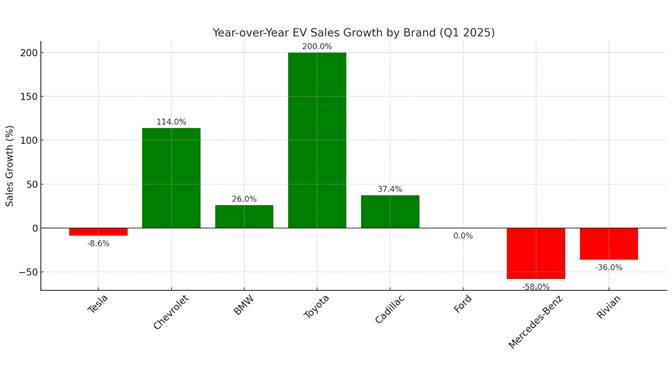

While EV sales as a whole are up, Tesla’s performance is slipping. Cox Automotive estimates Tesla sold around 128,100 vehicles in the U.S. in Q1 2025—a drop of 8.6% year-over-year. Globally, the company reported a 13% drop in deliveries, marking its worst quarter in nearly three years.

So, what’s going wrong for Tesla?

- Stagnant product lineup: Tesla hasn’t significantly updated its main vehicles in years.

- Public image concerns: Elon Musk’s polarizing public presence continues to draw backlash.

- Lack of new models: A promised low-cost model is on the horizon, but details remain unclear.

Cox warns that unless Tesla shakes up its product strategy, it could continue to lose market share in the U.S.

Other Automakers Seize the Moment

While Tesla stumbled, others surged ahead. Several automakers saw major gains in their EV sales during Q1:

| Brand | Year-over-Year Growth | Key Models |

|---|---|---|

| Chevrolet | +114% | Blazer EV, Equinox EV |

| BMW | +26% | i4 Sedan, iX SUV |

| Toyota | Nearly tripled | bZ4X SUV |

| Cadillac | +37.4% | Lyriq and new electric SUVs |

| Ford | Maintained #2 EV spot | Mustang Mach-E, F-150 Lightning |

Chevrolet stood out with its Equinox EV, which offers a solid 319-mile range and an affordable price tag—earning it accolades like the “Breakthrough EV of the Year.”

Ford held strong with 22,550 EVs sold, keeping its position as the second-largest EV seller in the U.S.

A wave of new EVs hit the market recently, giving consumers more variety than ever before. These models weren’t even available in early 2024 but are already boosting 2025’s sales numbers:

- Honda Prologue

- Acura ZDX

- Cadillac Escalade IQ

- Chevrolet Equinox EV

- Jeep Wagoneer S

- Mercedes G-Class EV

- Dodge Charger Daytona (EV version)

These fresh faces are helping the industry stay on an upward trajectory, but not everyone is riding the wave.

Some automakers struggled in Q1. Mercedes-Benz saw a massive 58% drop in EV sales. Its EQ line hasn’t connected with buyers, and a redesign is in the works. Meanwhile, EV startup Rivian saw deliveries fall by 36%, citing the California wildfires as one reason for the slowdown in its key market of Los Angeles.

Beyond individual brands, there are signs that broader challenges could be brewing:

- EV sales fell 19% between Q4 2024 and Q1 2025.

- New EVs accounted for 43,000 of Q1 sales, which means older models may not be selling as well.

- When comparing just the carry-over models, total sales actually dipped.

🌐 Policy & Tariff Headwinds Loom

While consumer interest remains, the EV market may face serious threats from shifting policies and international trade decisions.

- Trump-era tariffs on imported vehicles and car parts could raise costs for automakers and buyers alike.

- Steel and aluminum tariffs are especially problematic for EVs, which heavily rely on lightweight materials.

- $7,500 EV tax credit at risk: A Republican-majority Congress might cut this incentive, making EVs less attractive to cost-conscious buyers.

If these changes come to pass, the affordability and appeal of EVs could take a hit—especially for brands importing vehicles or components from abroad.

Cox Automotive believes the rest of 2025 will be “volatile” for EV sales. While consumer demand is still climbing, political and economic challenges could complicate things. Automakers that build EVs domestically and offer competitive pricing—like Ford, Hyundai, and Chevrolet—will likely weather the storm better.

Tesla, on the other hand, needs a strategic reboot. Without new models and a refreshed image, its dominance may continue to erode.

Key Takeaways

- EV sales grew 11.4% in Q1 2025—despite Tesla’s slump.

- Tesla’s U.S. sales dropped 8.6% year-over-year.

- Automakers like GM, BMW, Toyota, and Ford gained momentum.

- A wide range of new EV models helped boost Q1 numbers.

- Tariffs and potential policy changes pose serious risks.

- The rest of 2025 is expected to be unpredictable for the EV industry.

In short, the electric future is still alive and well—but it’s going through some growing pains. While Tesla faces challenges, competitors are rising fast. The next few months will be crucial in shaping the direction of the EV revolution.

PEOPLE WHO READ THIS, ALSO READ